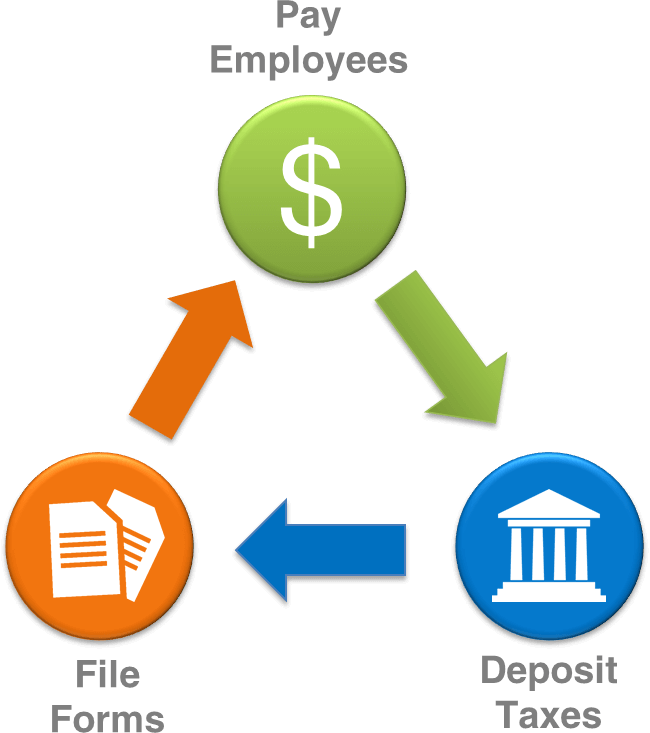

Despite the variety of various payroll management software, HR software, tools, and resources, there are still common problems faced with payroll in companies. Some of the errors faced by companies were organizational consistency in the payroll process, incorrect tax withholding, over and under payments, as well as other areas. While up-to-date software can enable HR, payroll, and employee data to be less overwhelming, if storage and processes are not well organized, you are open to complications. This can backup your payroll department by several days. But if you are partnering with us for your staffing solutions, then you are in luck. Payroll Management is a value added feature as per client requirements. Our efficient payroll system can be managed by our trained professionals for your convenience

To know more about our Payroll Management Software

Store employee’s profile with detailed employee report, employee monthly salary report, monthly EPF/ETF report, employee list department, designation, category and section wises

Accurate salary processing, employee statutory deductions and employer statutory contributions with the help of predefined processes

Supports user-defined production units i.e., attendance, production & time based unit

Facility to create user-defined earnings and deductions pay heads

Real-Time Attendance from Biometric Machine

Our payroll system can integrate with other software's as well

Provision for managing “End of Service” benefits like Gratuity and Full and Final Settlement

Built on Open standards based technologies

Can be deployed on 100% open source platforms and technologies

Can be deployed on premise, or on cloud platforms

Payroll provides tools for tracking working hours and approving leave with controlled access for employees

Discuss your Payroll Requirements

User-Friendly Interface

Scalable

Reduces TCO and increases ROI

Customizable as per client requirement

Saves time and lowers error possibilities

Speeds up tracking and maintaining information of salary transfer

Provision for managing “End of Service” benefits like Gratuity and Full and Final Settlement

The Minimum Wages Act, 1948

The Payment of Wages Act, 1936

The Labour Welfare Fund Act, 1965

The Profession Tax Act

The Contract Labour (Regulation & Abolition) Act, 1970

The Industrial Establishments (National & Festival Holidays) (Karnataka) Act, 1963

The Payment of Gratuity Act, 1972

The Equal Remuneration Act, 1976

The Maternity Benefit Act, 1961

The Payment of Bonus Act, 1965

Employees’ State Insurance Act, 1948

Employees’ Provident Fund and Miscellaneous Provisions Act, 1952

Enquire about our payroll compliances